As the week comes to a close we are scratching our heads wondering where is the 0.25% cut on interest rates, and how do we find it? As you may or may not know, on September 17th the fed announced rate cuts.

The Truth Behind Interest Rates

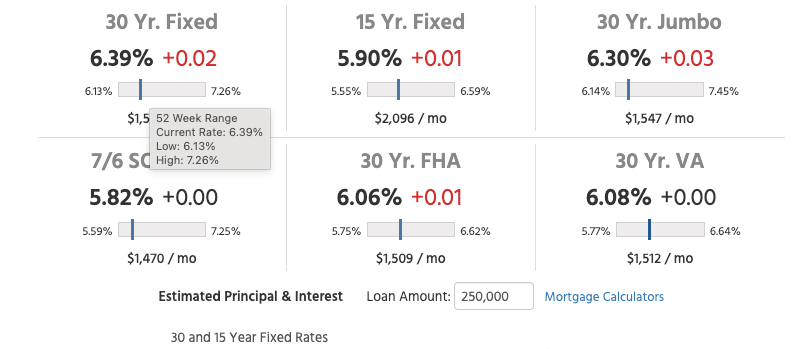

However, the truth is that mortgage interest rates are not directly “cut” by the fed. Instead they rise and fall in a direct relationship to the rate of the 10 year treasury bond. Which has been very volatile since the news of the upcoming rate cuts. Below is where rates are sitting right now as I write this. These rates are actually HIGHER than they were when the fed announced the interest rate cuts!

It appears that they have installed a trampoline on the 10 year treasury’s resistance line. Resistance lines are when a stock or bond refuses to drop below a certain price/rate because of market conditions. As a result, when the ticker hits 3.99% it almost immediately bounces back up to 4.125%+. Why is this happening you ask? Great question! Stocks and bonds rise and fall depending on 2 things supply and demand. The equilibrium of that supply and demand is the market value/rate.

How Is The 10 Year Treasury Interest Rates Determined?

If you’ve purchased stocks before you know that stock prices go up as the demand goes up. However, bonds work the opposite. When more bonds are purchased the interest rates actually go down. When less bonds are purchased the rates go up, regardless of what the fed says at their meetings.

It’s no surprise that when the fed announced the rate cuts investors are not rushing to buy bonds. Unless they’re getting a favorable rate of return of course. Furthermore, to entice investors to buy the bonds they increase the rate of return until there’s a purchase. The reason you’re seeing the trampoline affect once it hits 3.99% is because nobody wants to buy them below 4% right now. Until investors start buying bonds below 3.99% we won’t see an actual drop in mortgage interest rates.

What Should I Do Now?

Sometimes we don’t see the rate cuts from the fed meetings for months. Therefore, if you’re thinking of refinancing do it now, and contact us! That way you’re not over paying on your mortgage while you wait for them to drop. You can always refinance again. In fact, most programs allow you to refinance after you’ve made as little as 6 payments on the new mortgage!

Comments

One response

Share your thoughts!