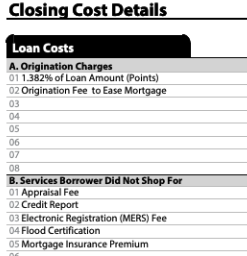

We’ve all received either a Loan Estimate or a Closing Disclosure and thought to ourselves “why are the closing costs so high?” It’s actually one of the most common questions I get as a loan officer. Above is a Closing Disclosure that I will be going over and explaining each section for you.

Section A: Origination Charges

This in essence is the cost of the loan. If you were heavily rate focused this section will be higher. However, don’t look at this as a bad thing. If you’re moving into or refinancing a home that you do not plan on leaving for at least the next 5 years buying the interest rate down is a good idea. If this is your forever home buy the rate down as much as the government will allow you to and it will save you tens of thousands of dollars over the term of the loan. Yes, there’s a limit to how much you can buy the rate down. More on this in a later post.

B. Services Borrower Did Not Shop For

These charges are fixed fees that the borrower did not shop for. Refer to your Loan Estimate for services that you can and cannot shop for. This example shows that the borrower did not shop for the appraisal fee, credit report, Electronic Registration Fee, Flood Certification, and Mortgage Insurance Premium. These just so happen to also be services that the borrower could not shop for. More on this in a later article.

Conclusion

There’s a lot that goes into closing on a mortgage. These are only 2 pieces of the Closing Disclosure (CD). I was going to go over an entire CD with you, but realized that would be a very long article. Since it’s Friday night and my family is looking forward to movie night I have to cut it short. However, stay tuned since there will be a continuation further explaining closing costs for those of you who are eager for more!